Your Medical Benefits

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Plan Information

Cigna Open Access Plus Choice Fund with HRA

Our medical plan is through Cigna’s Open Access Plus (OAP) network. This is a Preferred Provider Organization (PPO) plan, which gives you the flexibility to receive care from both in-network and out-of-network providers. Referrals are not required to see specialists who participate in the Cigna network.

This plan includes a Health Reimbursement Arrangement (HRA), which is fully funded by the company and works alongside your medical coverage. The HRA is designed to help pay for deductible and coinsurance costs for both in-network and out-of-network medical services. Each plan year, the company contributes $10,000 for employees with individual coverage and $20,000 for employees covering dependents.

Please note that the HRA does not cover copays, prescription medications, vision or dental expenses, or items eligible under a Flexible Spending Account (FSA).

Carrier Information

Cigna

Website: www.cigna.com

Phone: 866-494-2111

Employee Access: my.cigna.com

Provider Search: Click here

Your Medical Benefits

Carrier Information

Cigna

Website: www.cigna.com

Phone: 866-494-2111

Employee Access: my.cigna.com

Provider Search: Click here

Plan Information

Cigna One Guide®

Wellness isn’t just about visits to the doctor – it’s shaped by the choices we make every day. Cigna One Guide® combines smart digital tools with personalized support to simplify your entire health journey, helping you make informed decisions and stay connected to the care and resources you need.

Plan Documents

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Your Dental Benefits

Carrier Information

Principal

Website: www.principal.com

Phone: 800-832-4450

Employee Access: accounts.principal.com

Provider Search: Click here

Plan Information

Principal Dental Preferred Provider Organization (Dental PPO)

The Company offers Dental plan through Principal with valuable benefits:

- In-Network Benefits: Enjoy lower out-of-pocket costs when visiting dentists within our extensive network. Preventive care, such as cleanings and exams, is often covered at little to no cost.

- Out-of-Network Benefits: You have the freedom to visit any dentist of your choice, though out-of-pocket costs may be higher compared to in-network providers.

This plan ensures access to quality dental care while giving you the flexibility to choose the provider that best fits your needs.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employer pays 100% for the cost of coverage.

| Dental PPO | |

| Employee | $0 |

| Employee + Spouse | $0 |

| Employee + Child | $0 |

| Employee + Family | $0 |

Your Vision Benefits

Carrier Information

Cigna with Eyemed Network

Website: www.cigna.com

Phone: 877-478-7557

Employee Access: my.cigna.com

Provider Search: Click here

Plan Information

Cigna Vision with EyeMed Network

Our Cigna Vision plan provides comprehensive eye care coverage to help you maintain healthy vision. Cigna utilizes the EyeMed network, giving you access to a wide range of optometrists and ophthalmologists. Benefits include routine eye exams, prescription glasses, and contact lenses. Enjoy lower out-of-pocket costs when visiting in-network providers, along with discounts on lens enhancements, frames, and LASIK procedures.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employer pays 100% for the cost of coverage.

| Cigna Vision | |

|---|---|

| Employee | $0 |

| Employee + Spouse | $0 |

| Employee + Child | $0 |

| Employee + Family | $0 |

Your Life and AD&D Benefits

Carrier Information

Mutual of Omaha

Website: www.mutualofomaha.com

Phone: 800-655-5142

Employee Access: login.mutualofomaha.com

During Open Enrollment, you may increase your life insurance benefit by $10,000 up to the guaranteed issue amount ($150,000) without providing evidence of insurability if you’re already enrolled in this coverage. However, if you previously waived this coverage and are electing it for the first time, any new amount will be subject to evidence of insurability and approval by Mutual of Omaha.

Plan Information

Mutual of Omaha Life and AD&D Insurance

We provide employees with $50,000 in Life and Accidental Death & Dismemberment (AD&D) insurance at no cost to you through Mutual of Omaha. This benefit offers financial protection for you and your loved ones, ensuring peace of mind in the event of an unexpected loss. Life insurance provides a payout to your beneficiaries, while AD&D coverage offers additional protection in case of accidental death or serious injury.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employer pays 100% for the cost of coverage.

Benefits 101

Your Voluntary Life Benefits

Carrier Information

Mutual of Omaha

Website: www.mutualofomaha.com

Phone: 800-655-5142

Employee Access: login.mutualofomaha.com

Plan Information

The company offers Voluntary Life and Disability Insurance through Mutual of Omaha, providing employees, their spouses/domestic partners, and children with valuable financial protection. This optional coverage allows you to customize your benefits to meet your family’s unique needs, ensuring peace of mind in the face of unexpected events. With competitive group rates and convenient payroll deductions, you can secure additional life and disability coverage for yourself and your loved ones at an affordable cost. Investing in your future has never been easier.

During Open Enrollment, you may increase your life insurance benefit by $10,000 up to the guaranteed issue amount ($150,000) without providing evidence of insurability if you’re already enrolled in this coverage. However, if you previously waived this coverage and are electing it for the first time, any new amount will be subject to evidence of insurability and approval by Mutual of Omaha.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.

More on Voluntary Life Insurance

Your Long-Term Disability Benefits

Carrier Information

Mutual of Omaha

Website: www.mutualofomaha.com

Phone: 800-655-5142

Employee Access: login.mutualofomaha.com

Plan Information

Mutual of Omaha Long-Term Disability (LTD)

If you become unable to work due to a serious illness, injury, or medical condition that lasts for an extended period, the Company offers a company-paid Long Term Disability benefit that replaces 60% of your income up to $15,000 per month. This benefit is available through Mutual of Omaha at no cost to you. This is just one of the many ways we support our team and prioritize your peace of mind.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employer pays 100% for the cost of coverage.

Benefits 101

Your Voluntary Short-Term Disability Benefits (Non-California Employees Only)

Carrier Information

Mutual of Omaha

Website: www.mutualofomaha.com

Phone: 800-655-5142

Employee Access: login.mutualofomaha.com

Plan Information

Mutual of Omaha Voluntary Short-Term Disability (STD)

Short Term Disability (STD) insurance provides 60% replacement up to $1680/week if you become temporarily unable to work due to a non-work-related illness, injury, or pregnancy.

Eligibility

All full-time employees residing outside of California scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.

Benefits 101

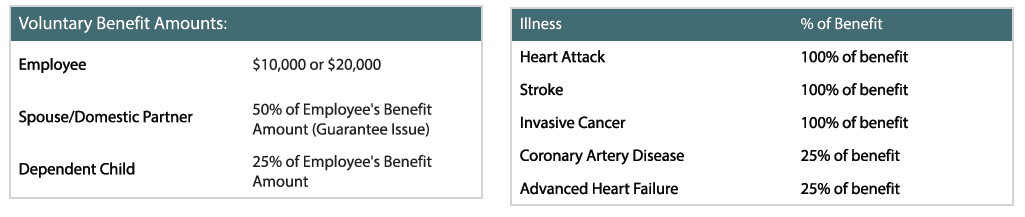

Your Voluntary Critical Illness Benefits

Carrier Information

Cigna

Website: www.cigna.com

Phone: 866-494-2111

Employee Access: my.cigna.com

Plan Information

The Critical Illness plan is designed to help employees offset the financial impact of a catastrophic illness with lump sum benefits if an insured is diagnosed with a covered critical illness. All employees are eligible to enroll with no Evidence of Insurability (EOI). The benefit amount is based on the coverage in effect on the date of diagnosis, or the date treatment is received according to the terms and provisions of the policy. Thus, please refer to the full benefit summary for examples of covered illness & payouts.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.

Benefits 101

Your Voluntary Accident Insurance Benefits

Carrier Information

Cigna

Website: www.cigna.com

Phone: 866-494-2111

Employee Access: my.cigna.com

Plan Information

The Accidental Injury plan is designed to help covered employees meet their out-of-pocket expenses and extra bills caused by an accidental injury, whether minor or catastrophic. Lump sum benefits are paid directly to the employee and their covered spouse and/or children based on the amount of coverage listed in the schedule of benefits.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.

Benefits 101

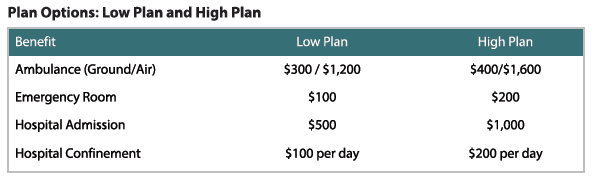

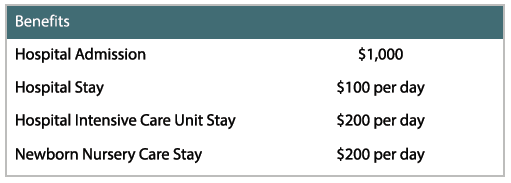

Your Voluntary Hospital Indemnity Benefits

Carrier Information

Cigna

Website: www.cigna.com

Phone: 866-494-2111

Employee Access: my.cigna.com

Plan Information

The Hospital Indemnity Coverage policy provides cash benefits to use as you see fit. The benefits are predetermined and paid regardless of any other insurance you have. Coverage pays benefits for a covered hospital stay resulting from a covered injury or illness.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.

Benefits 101

Your Voluntary Spending Accounts Benefits

Carrier Information

Paylocity

Website: www.paylocity.com

Phone: 314-909-6979

Employee Access: access.paylocity.com

Plan Information

A Flexible Spending Account (FSA) provides you with the opportunity to pay out-of-pocket medical, dental, vision, and dependent care expenses with pre-tax dollars. When you participate in an FSA, (depending on your tax bracket), you can save approximately 25% of each dollar spent on these expenses. The Company offers a Health Care FSA and a Dependent Care FSA, administered by Paylocity. Your FSA plan year is January 1 through December 31. During this plan year, you may set aside up to $3,400.00 pre-taxed dollars into a Health Care FSA Plan. This money can be used to pay for qualified medical, vision and dental expenses. For a full list of qualifying expenses, refer to IRS Publication 502 at irs.gov .

Dependent Care FSA

If you are single or married and file a joint tax return annually you can set aside up to $7,500.00 pre-taxed dollars during this plan year. If you are married but file a separate tax return, the maximum you can annually set aside is $3,750.00 pre-taxed dollars. This account is used for qualified daycare expenses for the care of a dependent. A dependent is defined as a person who is under 13 years of age who you claim as a dependent on your tax return or a person who is physically or mentally incapable of caring for himself or herself, regardless of age, who you claim as an exemption on your tax return. Refer to IRS Publication 503 for specific regulations.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.

Benefits 101

Your Employee Assistance Program (EAP) Benefits

Carrier Information

Paylocity

Website: www.paylocity.com

Phone: 314-909-6979

Employee Access: access.paylocity.com

Plan Information

Just when you think you have it figured out, along comes a challenge! Whether those challenges are big or small, your EAP Support Program is available to help you and your family find a solution and restore peace of mind.

Call Mutual of Omaha any day, any time. Support is just a phone call away whenever you need support – at no additional cost to you. An advocate is ready to help assess your needs and develop a solution to help resolve your concerns. Advocates can also direct you to an array of resources in your community and online tools. You and your household members have up to three face-to-face sessions available to use. Call for a referral to a service in your community, or advice on topics such as:

- Legal consultation: Receive a 30-minute free consultation and up to a 25% discount on select fees.

- Parenting: Receive guidance on child development, sibling rivalry, separation anxiety and much more.

- Senior care: Learn about challenges and solutions associated with caring for an aging loved one.

- Child care: Whether you need care all day or just after school, find a place that’s right for your family.

- Pet care: From grooming to boarding and veterinary services, find what you need to care for your pet.

- Temporary back-up care: Don’t let an unplanned event get the best of you – find back-up care.

For more information and to reach out for support, please call 1-800-316-2796 and provide Reference group #CK55 when calling or visit www.mutualofomaha.com/eap.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.

Benefits 101

Your Retirement Benefits

Carrier Information

Fidelity

Website: www.fidelity.com

Phone: 800-835-5097

Employee Access: nb.fidelity.com

Plan Information

Standard Employee Contribution Limit (under age 50):

You may contribute up to $24,500 (pre-tax and/or Roth), up from $23,500 in 2025.

Age 50+ Catch-Up Contribution Limit:

If you are age 50 or older, you may make an additional catch-up contribution of up to $8,000, increasing your total potential contribution to $32,500.

Ages 60-63 “Super” Catch-Up Contribution

If you are between ages 60 and 63, you may make an enhanced catch-up contribution of up to $11,250 (in lieu of the standard $8,000), increasing your total potential contribution to $35,750.

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee is paying 100% of coverage.

Benefits 101

Your Pet Insurance Benefits

Carrier Information

Pet Benefit Solutions

Website: Total Pet: www.petbenefits.com/land/azoff

Phone: 800-891-2565

Plan Information

TOTAL PET PLAN – PET CARE BUNDLE

- Comprehensive package offers savings on everything your pet needs

- No exclusions based on breed, age, or pre-existing health conditions

- Low cost, even if you have multiple pets

- Flat rates regardless of age, breed or zip code – a family plan covers all the pets in your home

- Can be used alongside pet insurance

Wishbone

Website: www.wishboneinsurance.com/azoff

Phone: 800-891-2565

WISHBONE – ACCIDENT & ILLNESS PLANS

- Reimbursement on exam fees, diagnostics, and treatment due to eligible accidents and illnesses

- Accident and illness rates are based on age, breed and zip code

- Pre-existing conditions are not covered

- Short waiting periods

- Easy claims submission with fast processing

- 30-day free look period*

- Get a quote at www.wishboneinsurance.com for additional information on coverage limits and waiting periods

Eligibility

All full-time employees scheduled to work 30 hours or more per week are eligible for coverage.

Contributions

Employee pays 100% for the cost of coverage.